18th November 2021

Women in small business leadership in the Midlands regions

Dr Samia Mahmood

Small businesses are important contributors to economic and social development. But how inclusive are these businesses, and what role do women play in leading and owning small businesses? And do we find the same patterns throughout the UK, or are there regional variations? To better understand the role of women ownership and leadership of small businesses among UK regions, we looked at the Longitudinal Small Business Survey[1] (LSBS 2015-2020).

According to this survey, only 17% of the small businesses are wholly women-led in the UK. However, almost half of small businesses in the UK are entirely male-led businesses, 21% are equally-led, and 13% have women in the minority. On the other hand, we also find considerable variation across the regions. For example, the proportion of wholly women-led business in the West Midlands and East Midlands is 1.4% and 1.2%, respectively, which is lower than the rest of England except for the North East and Yorkshire & the Humber.

.jpg)

Average across 2016-2020

Source: Longitudinal Small Business Survey (2020)

According to LSBS (2015-2020), 66.2 % of the women-led business are companies in the UK, 26.4% are sole proprietorships, and only 7.4% are a partnership. However, the proportion of women-led companies in the Midlands region is lower than in East England, London, South East and South West in England.

Access to finance can affect the ability to start and grow a small business, so we checked if there were any gender differences here. During 2016-2020, most women-led and equally led businesses in East Midland faced more obstacles in obtaining finance than women in the minority-led businesses and entirely male-led firms. In the West Midlands, all businesses face challenges in securing finance for the success of the business. However, the firms equally led by males and females reported greater challenges.

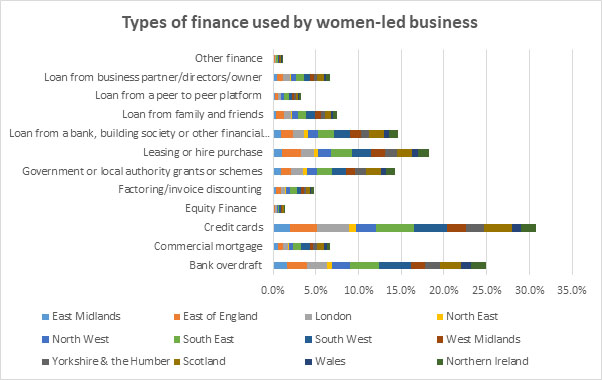

The types of finance used are also different. In the last five years, women-led businesses used mainly credit cards, bank overdrafts, and leasing or hire purchases. The least common types of finance are equity finance, loans from peer-to-peer platforms, and factoring/invoice discounting. Interestingly, small businesses in the East and West Midlands regions are at or below the average for the types of finance used in other regions.

Average across 2016-2020

Average across 2016-2020

Source: Longitudinal Small Business Survey (2020)

Why is there gender disparity in small businesses among the UK regions, and what are the reasons for a lower number of women-led businesses in the Midlands regions? One of the causes of such differences might be because some areas are more economically deprived than others, or some social or cultural factors might be the reason. To understand the regional dimension of women in leadership, we are working on a project funded by the Midlands Engine. This project will focus on a comprehensive picture of women on boards and women-owned businesses in the Midlands and sets out the potential pathways to improvement.

‘Women in Leadership in the Midlands’ Project

‘Co-funded by the Midlands Engine, this project addresses the regional dimension of women in business leadership. We will build an up-to-date and comprehensive picture of women on boards and women-owned businesses in the Midlands region, taking into account intra-regional variations, the national context and firm-specific characteristics. We will review and document the most up-to-date evidence base for the benefits and impacts of greater gender diversity in leadership, paying attention to different types of impacts and at various levels such as individual, organisational, and regional. Finally, the project will map and discuss the range of interventions to improve gender diversity in leadership. Through a combination of desk research, secondary data and primary data collection with regional stakeholders, we will provide a series of contextually grounded policy and practice recommendations for ‘what works’ at an individual, organisational and regional level to help promote women into leadership.’

The Project PI is Dr Samia Mahmood. Samia is a Senior Lecturer in Accounting and Finance and leads the Entrepreneurship and Small Business Management (ESBM) research cluster at Wolverhampton Business School. Her research focus is women entrepreneurship and empowerment, microfinance and SME financing. Her broad areas of research in women’s entrepreneurship include Constraints to access finance; Contextual embeddedness of women's entrepreneurship; Women empowerment and entrepreneurship. Moreover, she is interested in the impact of microfinance/SME finance on entrepreneurship development, poverty reduction and women’s empowerment.

The Project CI is Professor Silke Machold. Silke is the Dean of Research and Professor of Corporate Governance at the University of Wolverhampton. Her research interests are in behavioural aspects of boards of directors, board diversity and feminist ethics. She has led the research stream on a large EU Justice grant that focused on changing gender balance in boards in South-Eastern Europe, and contributed to the West Midlands Leadership Commission with work on regional dimensions of diversity and inclusion in boards of directors. In her role as Dean of Research, she has promoted initiatives to create and support inclusive research and research communities.

[1] Department for Business, Energy and Industrial Strategy. (2020). Longitudinal Small Business Survey, 2015-2020. [data collection]. 4th Edition. UK Data Service. SN: 7973, http://doi.org/10.5255/UKDA-SN-7973-4

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/iStock-163641275.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/250630-SciFest-1-group-photo-resized-800x450.png)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/210818-Iza-and-Mattia-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images/Maria-Serria-(teaser-image).jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/241014-Cyber4ME-Project-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/210705-bric_LAND_ATTIC_v2_resized.jpg)