FinTech; a sneak peek…..!!!

Can you imagine a day without your smart phone? An obvious answer from the younger generation is a “big no”, perhaps for the people from other age groups, it will be a difficult day. Technology has crept into our day-to-day activities bit by bit, and we cannot deny that it has significantly changed our lives. In recent years we have new buzz terms such as FinTech, Blockchain, and Cryptos. Let’s explore FinTech first.

Have you ever paid for your coffee by tapping on the card machine, bought a rail ticket with your phone, checked your bank statement online, transferred money using a mobile application, or paid for your shopping online? Does this sound familiar to you? If so, then congratulations you are already a part of the fastest growing multibillion dollar industry known as FinTech.

FinTech is a portmanteau of the terms Finance and Technology and refers to any business that uses technology to enhance or automate its financial services and processes. FinTech includes a range of technologies, businesses models and products that are changing the landscape of financial industries. Most people only associate FinTech with Blockchain and Crypto Currencies etc., which is not correct, as these are just one part of FinTech technologies and services. FinTech is not a new concept, with ATMs in the 1970`s being a good example of FinTech in the past, and Neobanks[1] are a good example of recent times. Online banking has been developed further with the introduction of Mobile banking.

Bill Gates was assumed naïve, when 25 years ago he said that “we need banking but don’t need banks anymore”. Bill Gates somehow predicted the future, and this statement sounds relevant to current times. First Direct is a telephone and internet-based retail bank with 1.45 million customers in the UK and Monzo, a UK based online bank, has more than 5million customers. Up until April 2022, we have 249 Neobanks and this number is growing.

Assessing customer credit ratings and making investment decisions are not new practices, but these are now carried out with the help of a centralised data base, software and algorithms known as Robo advisors. In simple words when we combine technology and service with a standard financial activity, we tag it as FinTech. Similarly other terms like, HealthTech and MediaTech, also indicate the introduction of technology in the health and media industry

But why is FinTech such a buzz word? One of the arguments is that the largest participants of the FinTech market are Gen Z and millennials, therefore, the pace of innovation, growth and adoption in this industry has been phenomenal in recent years. Another argument is that FinTech has filled all the loopholes of the conventional financial system, like a lack of access to financial services, or the higher cost of financial transactions for services, as well as complicated and time consuming processes. Moreover, due to Covid-19, and the introduction of remote and distance working, change in contact hours and virtual presence, it has been recognised that the use of technology is the only alternative to keep things going no matter what is happening around us. There are therefore a storm of start-ups who are offering payment and lending technologies and they are receiving funds. It is not just start-ups but big names like Apple, Google, Alibaba who have introduces Apple pay, Google pay, and Alipay. This industry has seen tremendous growth and the Global FinTech (GFT) market is estimated at $7,302 billion in 2020, and it is expected to grow at the rate of 27%. The GFT market can be segmented into technology, service, application and region. Though the actual size of the GFT market is not known, we can guess its size from the fact that 41 venture capital (VC) firms backed FinTech unicorns[2] collectively at a value of $151 billion.

Like any other growing industry FinTech also faces problems. Fraud risk is prevalent and there was a $4 billion OneCoin`s scam in 2016. Data security and privacy are another issue, with the 2018 Cambridge Analytica case being an example of this. Cyber-attacks are another risk and it is estimated that there is at least one cyber-attack every 30-40 seconds around the world and $7.7 billion was stolen as a consequence in 2021. Three major issues with FinTech are: lack of regulatory structure, shortage of tech experts and customer retention. Though the financial sector is the most regulated sector, the regulators could not keep pace with innovation in FinTech. As FinTech applications are broad and intersect across different business sectors, the regulator cannot create a one-size-fits-all regulatory framework for them. Building a top-notch financial solution is not cheap and easy, it requires hands-on experience. Most companies fail to form strong in house teams. Lack of relevant tech experts can result in a service which is not user friendly or deprive a company from multiple benefits of the technology. The FinTech industry is growing with the introduction of a new company every second day. Most of the existing FinTech companies are young, and they struggle to maintain their market share due to new entrants. Due to this disruption, customer retention is a permanent issue.

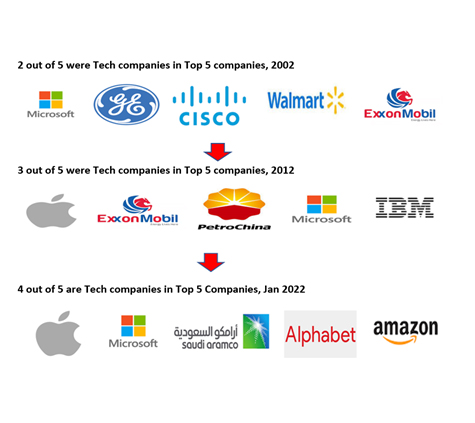

The future of FinTech is clear, it will dominate the market. The FinTech bubble is growing very fast, and to stop this bubble from bursting its major issues need urgent attention. If the issues are addressed, then artificial intelligence, blockchain, cloud computing, IoT, open source, no/cheap code, machine learning and hyper automation will change the future of FinTech as it is embedded. Financial services will not be offered as stand-alone products but will be part of the user interface of other products. Technology is clearly changing the landscape of the corporate sector:

It is not difficult to guess what the landscape will look like in ten years’ time. However, the most important question is “are you prepared for the future”. I can suggest an answer with a saying, you can’t stop the waves, but you can learn to surf.

-ends-

By Nadia Asghar, Senior Lecturer, Finance, Accounting and Economics

University of Wolverhampton Business School

[1] Neobanks are banks without any physical branch locations, they serve customers with checking, savings, payment services and loans on completely mobile and digital infrastructure. Till April 2022, we have 249 such banks.

[2] Unicorn is a private company worth at least $ 1 billion.

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/240328-Varsity-Line-Up-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-18-19/220325-Engineers_teach_thumbail.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/240423-Additive-Research-Centre-Launched.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/240320-Uzbekistan-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/240229-The-Link-Resized.jpg)

/prod01/wlvacuk/media/departments/digital-content-and-communications/images-2024/240423-Arts-Connect-Resized.jpg)